Investment momentum: myth or money-maker?

Asset pricing models provide a framework for investors to calculate investment risk and determine the expected return on an investment. The value and size effects are some of the more well-researched risk factors and it has been found that, over the long term, they can be taken advantage of to secure excess returns. For example, well diversified investors might choose to overweight smaller and cheaper companies based on some price-to-fundamental measure such as book value. Amidst this wealth of research, certain market phenomena are still not fully understood and are hotly debated. One of the most popular of these is known as momentum.

Momentum is, in theory, a straightforward concept. Just as an object with momentum continues moving in its current direction , a stock with momentum exhibits a persistent trend in its price. In practical terms, this means that a stock that has been rising in price is likely to continue rising, while one that has been falling is likely to continue declining. As such, to implement a strategy that attempts to capitalise on momentum, one would buy stocks whose price has been rising and sell stocks whose price has been falling.

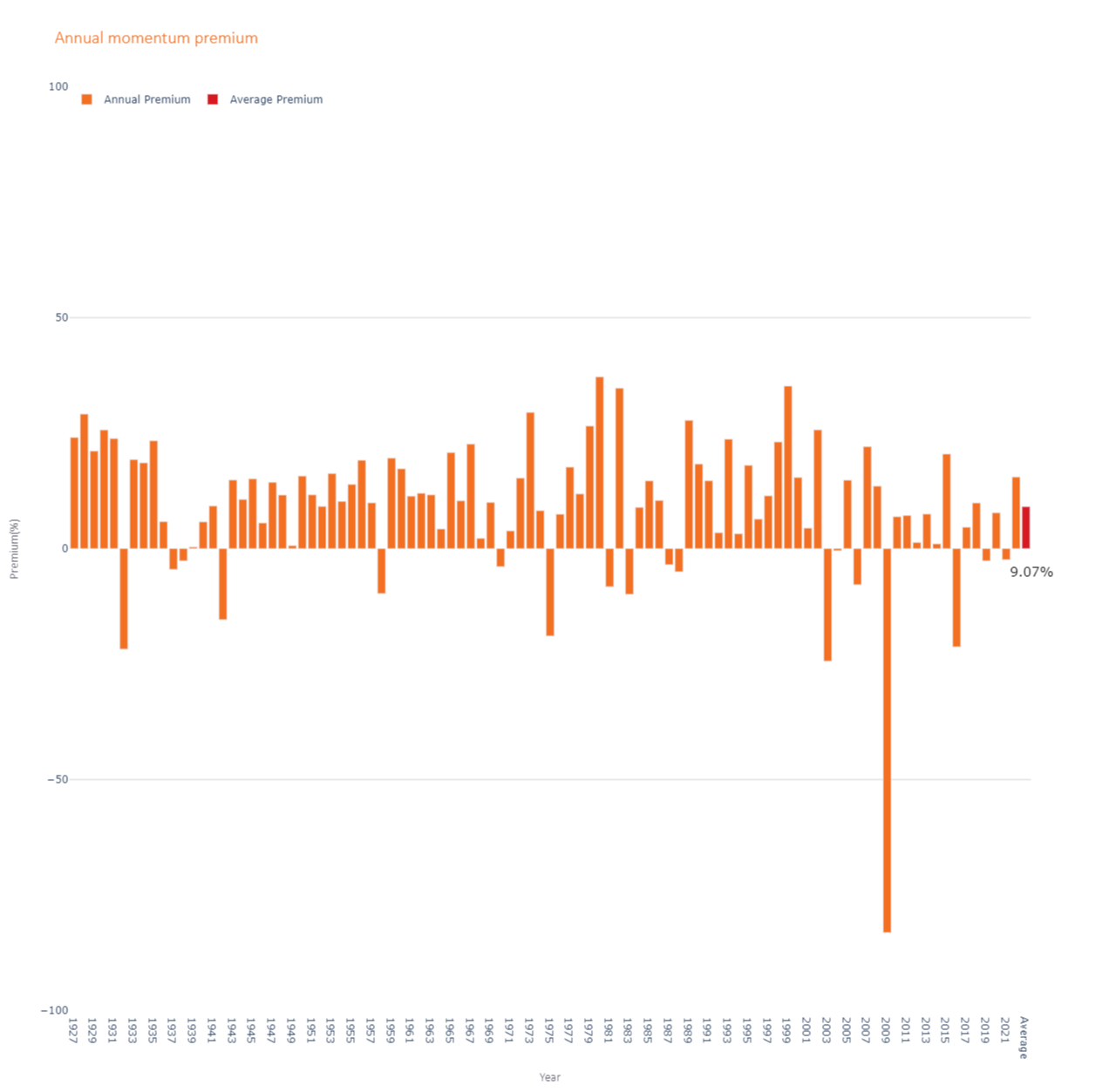

Now we have a broad definition of the momentum effect, is there evidence of its existence? Over recent decades numerous studies have been dedicated to unravelling the mysteries of momentum. The first of these was Jegadeesh & Titman, (1993) who implemented a momentum strategy in the US market and calculated an average yearly return of 12% (USD). This compares with an average return of the S&P 500 for this period which was 10.2%. Several other papers have investigated momentum across many markets, consistently confirming the presence of this phenomenon and suggesting profitable strategies based on its success. Even Eugene Fama has referred to momentum as “the biggest challenge to his theory of financial market efficiency” (Fama, 2007)! Figure 1 below demonstrates the momentum premium on a year by year basis since 1927.

The weight of evidence suggests that momentum exists in financial markets. However, should investors rush to incorporate it into their portfolios? Well, not necessarily. Wes Crill at Dimensional examined the profitability of momentum funds in the US (Crill, 2018). He identified eleven such funds and found that, despite these funds showing strong exposure to the momentum premium, only one had managed to outperform the Russell 3000 index. This underperformance can be attributed to the high costs associated with the frequent trading inherent in momentum-based strategies. Momentum is a risk factor that tends to decay quickly or, said differently, the stocks with high momentum today are likely to be very different from those that have high momentum in six months’ time. For example, the MSCI World Momentum Index exhibited an annual turnover of 111% at the time of writing1. Figure 2 above demonstrates the innate difficulty in implementing a momentum based strategy that works, since October 2014 the momentum strategy has returned pretty much the same as the market, but with a much higher level of volatility.

So, should we disregard momentum completely? Probably not. Systematic asset managers, such as Dimensional and Avantis, suggest considering momentum at the trading level when buying and selling based on other characteristics such as value and size, attempting to take advantage of the favourable upward momentum premium when doing so. This would hopefully lead to an enhanced return due to momentum, without the high costs. Furthermore, there's the possibility that a fund could emerge with a well-executed, cost-efficient high-turnover momentum strategy. Asset managers such as AQR, Xtrackers and iShares have funds that consider momentum in the construction approach as opposed to the trading level. Hence, investors would be wise to be mindful of momentum when making decisions for their portfolios.

This is a purely educational article to discuss some general investment related issues. It does not in any way constitute investment advice or arranging investments. It is for information purposes only; any information contained within is the opinion of the author, which can change without notice. All information is based on sources that the author believes to be reliable. No responsibility can be accepted for actions taken as a result of reading this article.

1 MSCI (2023) MSCI World Momentum Factsheet (September 2023)

Bibliography:

Crill, W., 2018. Dimensional. [Online] Available at: https://www.dimensional.com/us-en/insights/have-investors-benefited-from-momentum-strategies [Accessed 29 09 2023].

Fama, E., 2007. Interview with Eugene Fama [Interview] (1 December 2007).

Jegadeesh, N. & Titman, S., 1993. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance, 48(1), pp. 65-91.

Related Blogs

Get in touch

Don't hesitate to get in touch - we would be delighted to receive your call or email. For enquiries about our service, please use the contact form and one of the team will respond in due course.